Depreciation, in financial terms, represents the allocation of the cost of a tangible asset over its useful life. It's a crucial concept for understanding a company's financial health and accurately reflecting its assets' true value over time. Think of it this way: you buy a car. It's brand new, but every year its value decreases due to wear and tear, obsolescence, and simply being a year older. Depreciation accounts for this decline in value.

Why is depreciation important? Firstly, it's a matching principle requirement under Generally Accepted Accounting Principles (GAAP). This principle dictates that expenses should be recognized in the same period as the revenues they help generate. By expensing a portion of an asset's cost over its useful life, depreciation helps match the cost of the asset with the revenue it generates during that time. Without depreciation, the entire cost would be expensed in the year of purchase, artificially lowering profits in that year and overstating them in subsequent years.

Secondly, depreciation provides a more accurate picture of a company's profitability. It helps to smooth out earnings over time, presenting a more consistent and realistic view of performance. This is beneficial for investors and stakeholders who rely on financial statements to make informed decisions.

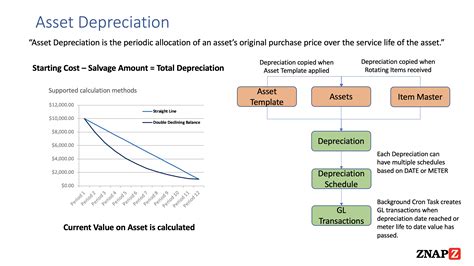

There are several methods for calculating depreciation, each with its own nuances. Some of the most common include:

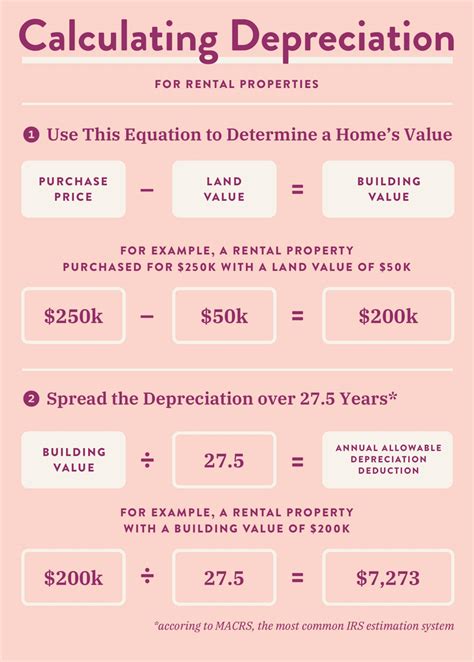

- Straight-Line Depreciation: This is the simplest method, where the asset depreciates by the same amount each year. The formula is (Cost - Salvage Value) / Useful Life. Salvage value is the estimated value of the asset at the end of its useful life.

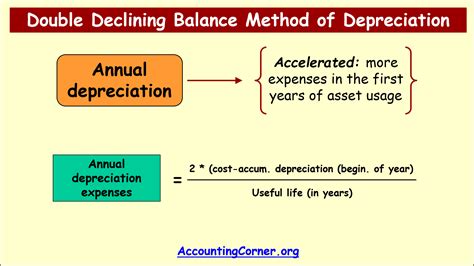

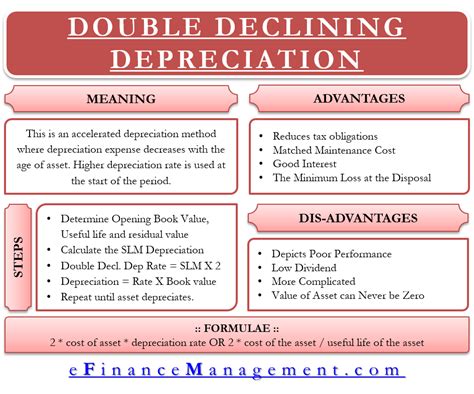

- Double-Declining Balance: This is an accelerated depreciation method that results in higher depreciation expense in the early years of the asset's life and lower expense later on. It's calculated as 2 * (Straight-Line Depreciation Rate) * Book Value. Book value is the asset's cost less accumulated depreciation.

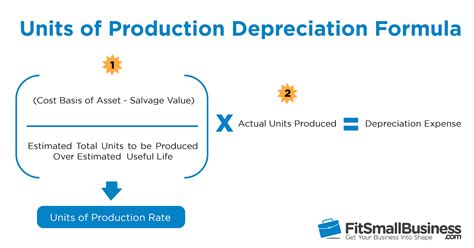

- Units of Production: This method depreciates the asset based on its actual usage or output. The depreciation expense is calculated based on the actual units produced or service provided relative to the total estimated units or service the asset can provide.

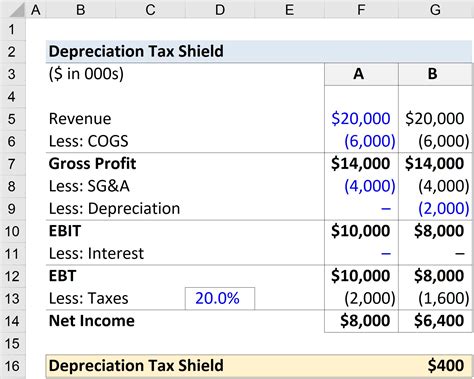

The choice of depreciation method can significantly impact a company's reported earnings and tax liability. Companies often choose a method that aligns with their specific industry and asset type. For example, a manufacturing company with heavy machinery might use an accelerated method to reflect the faster rate of wear and tear.

It's important to note that depreciation is a non-cash expense. While it reduces net income, it doesn't involve an actual outflow of cash. This is why depreciation is often added back to net income when calculating cash flow from operations. This adjustment helps to determine the true cash-generating ability of the business.

In conclusion, depreciation is a vital accounting concept that reflects the decline in value of tangible assets over time. It ensures accurate financial reporting, matches expenses with revenues, and provides a more realistic view of a company's profitability. Understanding depreciation methods and their impact on financial statements is crucial for investors, analysts, and anyone seeking to assess a company's financial performance effectively.

1200×900 accelerated depreciation electric vehicle charging settings sybil kristan from arleeqclarice.pages.dev

1200×900 accelerated depreciation electric vehicle charging settings sybil kristan from arleeqclarice.pages.dev

2318×1502 bonus depreciation calculator nicky anabella from tracyyauguste.pages.dev

2318×1502 bonus depreciation calculator nicky anabella from tracyyauguste.pages.dev

1500×1000 depreciation rate construction equipment yvette seo blog from storage.googleapis.com

1500×1000 depreciation rate construction equipment yvette seo blog from storage.googleapis.com

3000×2000 depreciation calculated from tvasherbrooke.com

3000×2000 depreciation calculated from tvasherbrooke.com

951×674 depreciation definition examples market business news from www.cnss.gov.lb

951×674 depreciation definition examples market business news from www.cnss.gov.lb

961×697 depreciation rules nissa anallise from leabmerilyn.pages.dev

961×697 depreciation rules nissa anallise from leabmerilyn.pages.dev

556×371 depreciation expense accounting methods dummies from www.dummies.com

556×371 depreciation expense accounting methods dummies from www.dummies.com

0 x 0 calculate declining balance method depreciation from www.youtube.com

0 x 0 calculate declining balance method depreciation from www.youtube.com

2002×1127 double declining balance method depreciation accounting corner from accountingcorner.org

2002×1127 double declining balance method depreciation accounting corner from accountingcorner.org

1024×461 depreciation formula calculate depreciation expense from www.wallstreetmojo.com

1024×461 depreciation formula calculate depreciation expense from www.wallstreetmojo.com

2048×1170 types depreciation from www.civilease.com

2048×1170 types depreciation from www.civilease.com

1024×526 straight depreciation method accounting from www.online-accounting.net

1024×526 straight depreciation method accounting from www.online-accounting.net

1200×1200 depreciation definition types purpose from moneysmint.com

1200×1200 depreciation definition types purpose from moneysmint.com

1200×872 double declining balance method depreciation from www.careerprinciples.com

1200×872 double declining balance method depreciation from www.careerprinciples.com

1497×2831 depreciation calculated quickbooks south africa from quickbooks.intuit.com

1497×2831 depreciation calculated quickbooks south africa from quickbooks.intuit.com

1080×810 depreciation schedule template straight calculator diminishing from www.etsy.com

1080×810 depreciation schedule template straight calculator diminishing from www.etsy.com

1024×768 depreciation recapture tax rate hatti koralle from marshawfarra.pages.dev

1024×768 depreciation recapture tax rate hatti koralle from marshawfarra.pages.dev

900×500 bonus depreciation rates jess romola from kristiwnancy.pages.dev

900×500 bonus depreciation rates jess romola from kristiwnancy.pages.dev

550×539 depreciation definition objectives methods business jargons from businessjargons.com

550×539 depreciation definition objectives methods business jargons from businessjargons.com

3344×1878 asset depreciation introduction summary maximo secrets from maximosecrets.com

3344×1878 asset depreciation introduction summary maximo secrets from maximosecrets.com

1500×1000 accumulation definition from ar.inspiredpencil.com

1500×1000 accumulation definition from ar.inspiredpencil.com

1200×1200 currency depreciation appreciation definitions examples thestreet from www.thestreet.com

1200×1200 currency depreciation appreciation definitions examples thestreet from www.thestreet.com

1197×675 depreciation calculate depreciation business from www.shiksha.com

1197×675 depreciation calculate depreciation business from www.shiksha.com

1024×526 depreciation expenses formula examples excel template from www.educba.com

1024×526 depreciation expenses formula examples excel template from www.educba.com

1536×458 depreciation meaning types calculation glossary from www.tickertape.in

1536×458 depreciation meaning types calculation glossary from www.tickertape.in

1162×743 accumulated depreciation overview works from corporatefinanceinstitute.com

1162×743 accumulated depreciation overview works from corporatefinanceinstitute.com

1280×720 depreciation rental property work eligibility from www.educba.com

1280×720 depreciation rental property work eligibility from www.educba.com

800×450 depreciation methods check formula factors types especia from especia.co.in

800×450 depreciation methods check formula factors types especia from especia.co.in

1024×526 accumulated depreciation assets falasislam from falasislam.weebly.com

1024×526 accumulated depreciation assets falasislam from falasislam.weebly.com

945×787 financial accounting efinancemanagementcom from efinancemanagement.com

945×787 financial accounting efinancemanagementcom from efinancemanagement.com

1500×1000 depreciation accumulated depreciation expense from ar.inspiredpencil.com

1500×1000 depreciation accumulated depreciation expense from ar.inspiredpencil.com

1200×675 depreciation expense double entry bookkeeping from www.double-entry-bookkeeping.com

1200×675 depreciation expense double entry bookkeeping from www.double-entry-bookkeeping.com

1772×2475 deduct rental property depreciation wealthfit from wealthfit.com

1772×2475 deduct rental property depreciation wealthfit from wealthfit.com

900×500 calculate depreciation disposal fixed assets edward from storage.googleapis.com

900×500 calculate depreciation disposal fixed assets edward from storage.googleapis.com

2500×1309 units production depreciation calculate formula from fitsmallbusiness.com

2500×1309 units production depreciation calculate formula from fitsmallbusiness.com

1770×1418 bonus depreciation calculator cissy deloris from prudivfelecia.pages.dev

1770×1418 bonus depreciation calculator cissy deloris from prudivfelecia.pages.dev

1280×720 depreciate heavy equipment elizabeth gunther blog from storage.googleapis.com

1280×720 depreciate heavy equipment elizabeth gunther blog from storage.googleapis.com

768×435 depreciation gcse maths steps examples worksheet from thirdspacelearning.com

768×435 depreciation gcse maths steps examples worksheet from thirdspacelearning.com

1280×720 funding resources mortgage corp maryleerenee from maryleerenee.blogspot.com

1280×720 funding resources mortgage corp maryleerenee from maryleerenee.blogspot.com

625×404 double declining balance method definition meaning from www.myaccountingcourse.com

625×404 double declining balance method definition meaning from www.myaccountingcourse.com

1920×1080 factors affect car depreciation rate indus from indususedcars.com

1920×1080 factors affect car depreciation rate indus from indususedcars.com

3200×2400 ways account accumulated depreciation wikihow from www.wikihow.com

3200×2400 ways account accumulated depreciation wikihow from www.wikihow.com

5465×3418 accumulated depreciation credit balance from www.investopedia.com

5465×3418 accumulated depreciation credit balance from www.investopedia.com

1200×1552 chapter depreciation guide computation system level from nap.nationalacademies.org

1200×1552 chapter depreciation guide computation system level from nap.nationalacademies.org

1280×719 depreciation expense debit credit financial falconet from financialfalconet.com

1280×719 depreciation expense debit credit financial falconet from financialfalconet.com

3200×2400 ways calculate depreciation fixed assets wikihow from www.wikihow.com

3200×2400 ways calculate depreciation fixed assets wikihow from www.wikihow.com

900×1200 depreciation schedule examples from www.examples.com

900×1200 depreciation schedule examples from www.examples.com

920×930 les depreciations digischool from www.digischool.fr

920×930 les depreciations digischool from www.digischool.fr

1275×1650 solution straight method depreciation solved problems studypool from www.studypool.com

1275×1650 solution straight method depreciation solved problems studypool from www.studypool.com

1920×1080 smart ways avoid depreciation tax rental property from andersonadvisors.com

1920×1080 smart ways avoid depreciation tax rental property from andersonadvisors.com

1200×849 bonus depreciation effects details analysis tax foundation from taxfoundation.org

1200×849 bonus depreciation effects details analysis tax foundation from taxfoundation.org

1546×1063 amortissement lineaire ce quil faut savoir mihfada from mihfada.com

1546×1063 amortissement lineaire ce quil faut savoir mihfada from mihfada.com

886×513 depreciation method tools terry maurer blog from storage.googleapis.com

886×513 depreciation method tools terry maurer blog from storage.googleapis.com

441×283 depreciation summary forum manage from www.12manage.com

441×283 depreciation summary forum manage from www.12manage.com

3021×1608 defining calculating written method from khatabook.com

3021×1608 defining calculating written method from khatabook.com

1920×1536 amortization depreciation methods calculating from www.vecteezy.com

1920×1536 amortization depreciation methods calculating from www.vecteezy.com